The recent leak of the tax returns of billionaires Elon Musk, Jeff Bezos and Warren Buffet (among others) has prompted the Biden administration to investigate exactly how this confidential IRS information became public. Multiple agencies, most notably the FBI, the U.S. Inspector General and the U.S. Attorney for the District of Columbia are investigating the leak.

The leak was reported by ProPublica earlier this month.

This latest cyber-security breakdown underscores the vulnerability of personal data in today’s big-data reality, and, moreover, the importance of protecting confidential, private information at all costs.

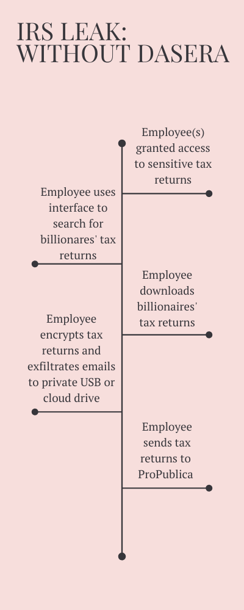

All signs point to an internal leak at the IRS. However, tracking such a leak may prove difficult.

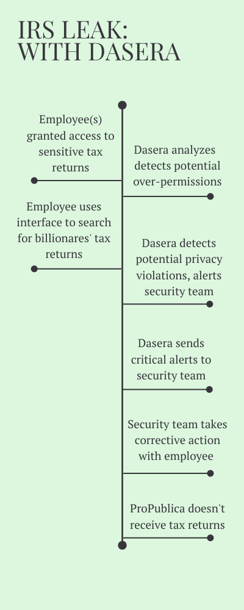

Dasera helps prevent these very problems by tracking data movement across the data life cycle (from data creation to archival), so sensitive data is protected. Surely, any investigation will focus on four key questions:

- Where are these tax returns stored?

- Who has access to these tax returns?

- Who actually accessed these returns?

- Among these accesses, was data used inappropriately? e.g., Was the download button hit when it shouldn’t have been? Was there an employee who accessed returns for Warren Buffet, Bill Gates, and Elon Musk?

- Most importantly: Who likely leaked the tax returns? Was this a case of employee malfeasance or a case of compromised credentials?

Dasera tackles all these challenges -- especially Question number 4, which addresses data in use -- by securing the entire Data Lifecycle. See our before and after scenarios below and read our 1 page overview to learn more.